In the world of tech, few companies have experienced the astronomical rise that Nvidia (NASDAQ: NVDA) has seen in recent years. Since the start of 2024, Nvidia’s stock has soared by an incredible 167%, marking yet another chapter in the company’s growth story. Over the past five years, the stock has surged by an eye-watering 3,450%, a testament to Nvidia’s dominance in the semiconductor and AI markets. This remarkable growth has not only elevated the company’s market value to a staggering $3.2 trillion but has also transformed the financial landscape for many of its employees.

The Financial Transformation of Nvidia Employees

For those who joined Nvidia five or more years ago, the surge in stock value has likely translated into significant personal wealth. Many of these long-term employees have seen their stock options and RSUs (restricted stock units) appreciate dramatically, potentially turning them into millionaires. It’s not just the senior executives; even midlevel managers are reportedly making over $1 million annually, thanks to the combination of salary, stock options, and the overall appreciation of Nvidia’s stock.

However, this newfound wealth has had some unintended consequences. According to reports, many established Nvidia executives are now operating in a “semi-retirement” mode, seemingly less motivated to work as hard as they used to. This shift in work ethic has not gone unnoticed by Nvidia’s CEO, Jensen Huang.

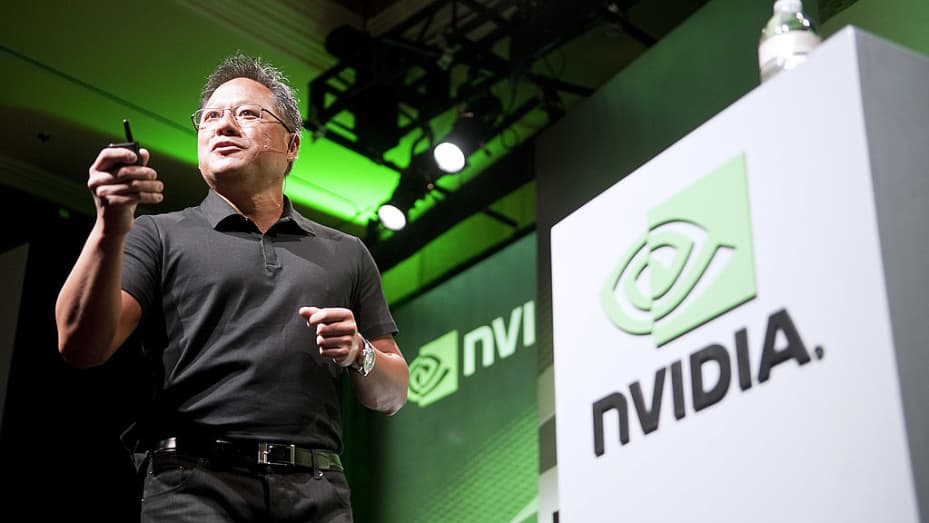

Jensen Huang’s Response

When questioned about the ‘semi-retired’ employees, Huang advised all workers to act as the ‘CEO’ of their own time. He emphasized the importance of personal responsibility and work ethic, even as he himself received a 60% pay boost last fiscal year, bringing his total compensation to $34.2 million. Despite the immense financial success, Huang’s message was clear: the drive to innovate and excel must remain strong.

The Reality Behind Nvidia’s Compensation Packages

While it might appear that all Nvidia employees are reaping the benefits of the company’s success, the reality is more nuanced. A Nvidia engineer, who earns $250,000 annually and is based on the West Coast, shared his perspective with Business Insider. He explained that employee salaries at Nvidia, though impressive at first glance, don’t always translate into long-term wealth.

This engineer, who receives almost half of his base salary in the form of RSUs, pointed out that not everyone receives a large number of stock units. There are caps on how many RSUs employees can receive, with even top performers limited to 50% of their base salary in stock each year.

“You will end up cashing your stocks to meet your annual obligations in terms of personal taxes, property taxes, and any other expenses you will have,” he said. This reality underscores a significant point: the perception of wealth can be quite different from the day-to-day financial reality for many employees.

The Challenge of Holding Onto Stock

The experience of Nvidia employees is not unique in the tech industry. As former Tesla director of AI Andrej Karpathy noted, “Most people don’t HODL, and the government takes half.” This sentiment reflects a broader challenge faced by employees at companies like Nvidia and Tesla. While the potential for becoming a millionaire is real, many employees end up selling their stock early to cover immediate financial needs and obligations. Long-term holders, on the other hand, are often waiting for significant milestones—such as Tesla achieving fully autonomous driving with its FSD software—before they sell their shares at a premium.

Nvidia’s success story is a remarkable example of how a company’s growth can transform the lives of its employees. However, the journey to financial security is complex and varies greatly among individuals. While some have indeed struck it rich, others find themselves navigating the challenges of maintaining and managing their wealth amidst a landscape of rising living costs and significant tax obligations. As Nvidia continues to innovate and lead in the tech industry, its employees must balance the benefits of their compensation packages with the realities of their financial obligations.